The digital landscape is constantly evolving, with innovations reshaping how we interact with technology. One of the most transformative trends in recent years is the rise of “Super Apps.” In recent years, the concept of Digital financial services and super apps has revolutionized the digital landscape, particularly in the realm of financial services. Super apps have rapidly gained traction worldwide, offering a seamless integration of various services within a single platform. Super App is a multi-functional application that is not just reshaping how we manage our finances but is also revolutionizing the broader digital ecosystem. This blog explores the phenomenon of Digital financial services and super apps, their impact on financial services, and what the future holds.

What Are Digital Financial Services and Super Apps?

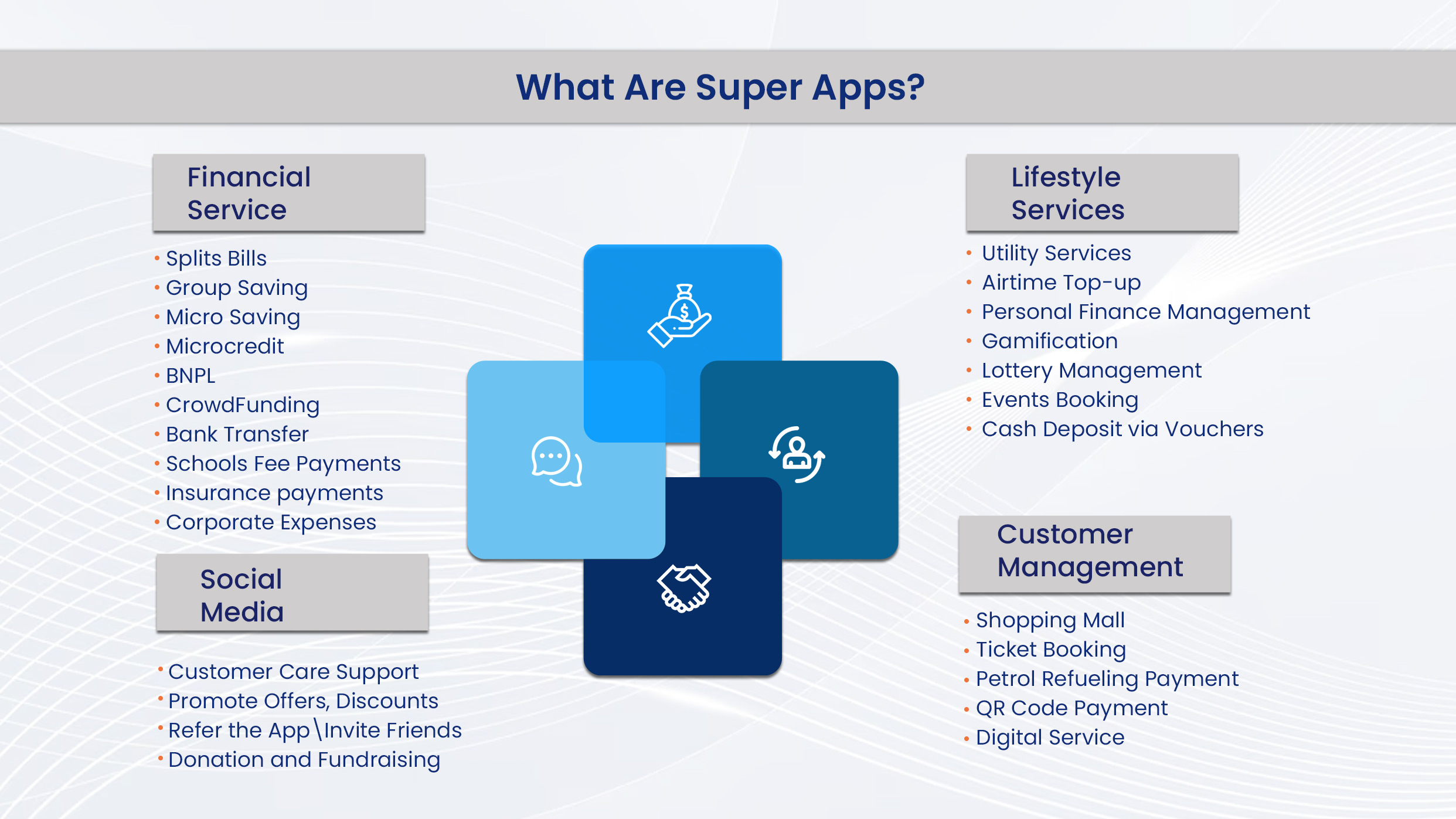

6D Technologies Super apps are multi-functional mobile applications that provide a wide range of services, such as messaging, payments, shopping, and more, all within one platform. Unlike traditional apps that serve a singular purpose, Digital financial services and super apps aim to create an ecosystem that meets numerous user needs, thereby enhancing convenience and user engagement.

The Rise of Super Apps in Financial Services

The integration of financial services into Digital financial services and super apps has marked a significant shift in the fintech industry. This section delves into the factors driving this trend and the benefits it offers to both users and service providers.

Drivers of Adoption

- Convenience and User Experience: Super apps simplify user experience by consolidating multiple services into a single interface. This reduces the need for multiple app installations and logins, making financial transactions more accessible and efficient.

- Technological Advancements: The proliferation of smartphones and advancements in mobile technology have facilitated the growth of Digital financial services and super apps. Enhanced connectivity and data analytics enable these apps to offer personalized and real-time financial services.

- Strategic Partnerships: Collaborations between fintech companies and super apps have accelerated the adoption of integrated financial services. These partnerships enable the pooling of resources and expertise, leading to innovative financial solutions.

- Regulatory Support: In many regions, regulatory frameworks have evolved to support digital financial services, providing a conducive environment for the growth of Digital financial services and super apps.

6D Technologies Super App Benefits

Benefits for Users

- Streamlined Financial Management: Super apps offer a unified platform for managing various financial activities, such as payments, savings, investments, and insurance. This holistic approach simplifies financial management for users.

- Enhanced Security: Super apps leverage advanced security protocols, including biometric authentication and encryption, to protect user data and transactions. This instills greater confidence in digital financial services.

- Cost Savings: By reducing the need for multiple financial service providers, Digital financial services and super apps can offer cost savings through lower fees and competitive pricing.

Benefits for Service Providers

- Increased User Engagement: Super apps enhance user engagement by providing a comprehensive range of services, leading to higher customer retention and loyalty.

- Data-Driven Insights: The vast amount of data generated by Digital financial services and super apps enables service providers to gain valuable insights into user behavior, preferences, and trends, facilitating the development of targeted financial products.

- Revenue Diversification: Digital financial services and super apps open new revenue streams for service providers through fees, commissions, and value-added services.

Challenges and Considerations

While super apps offer numerous benefits, their rise also presents several challenges and considerations for stakeholders.

- Regulatory and Compliance Issues: The integration of financial services within super apps necessitates compliance with stringent regulatory requirements. Ensuring data privacy, combating fraud, and adhering to financial regulations are critical to maintaining user trust and avoiding legal repercussions.

- Competition and Market Saturation: The rapid proliferation of Digital financial services and super apps has led to increased competition in the digital financial services space. Differentiating offerings and maintaining a competitive edge are essential for the sustained success of super apps.

- Technological and Security Concerns: As Digital financial services and super apps handle a vast amount of sensitive user data, ensuring robust cybersecurity measures is paramount. Continuous investment in technology and security infrastructure is necessary to protect against cyber threats and maintain user confidence.

- User Adoption and Trust: Building and maintaining user trust is crucial for the widespread adoption of super apps. Transparent communication, reliable customer support, and consistent delivery of high-quality services are key to fostering user loyalty.

The Future of Super Apps in Financial Services

The future of Digital financial services and super apps in financial services looks promising, with several trends poised to shape their evolution.

- Expansion into New Markets: Super apps are likely to expand into new geographic markets, particularly in regions with high mobile penetration and growing demand for digital financial services. Strategic partnerships and localization efforts will be critical to their success in these markets.

- Integration of Advanced Technologies: The integration of advanced technologies, such as artificial intelligence (AI), machine learning, and blockchain, will enhance the capabilities of super apps. These technologies can provide personalized financial solutions, improve security, and streamline operations.

- Focus on Financial Inclusion: Digital financial services and super apps have the potential to drive financial inclusion by providing accessible and affordable financial services to underserved populations. Initiatives aimed at expanding financial literacy and access to digital financial tools will be pivotal in this regard.

- Interoperability and Partnerships: To enhance their value proposition, super apps will increasingly focus on interoperability and partnerships. Collaborating with banks, fintech startups, and other service providers will enable them to offer a more comprehensive and diverse range of financial services.

Conclusion

6D Technologies Super apps are transforming the digital experience by integrating a myriad of services into a single, seamless platform. 6D Technologies Super App is redefining convenience, enhancing user engagement, and driving financial inclusion. As Digital financial services and super apps continue to evolve and expand globally, they will play an increasingly pivotal role in shaping the future of the digital economy. Embracing this trend will be essential for businesses, consumers, and regulators as we navigate the exciting possibilities of this digital revolution. While challenges remain, the potential benefits of Digital financial services and super apps are immense, promising a future where digital financial services are more accessible and inclusive than ever before.

Thought Leadership Insights: Abhishek Singh, Senior Manager