In the dynamic landscape of the telecommunications industry, real-time insights into various aspects of business operations are crucial for success. The intricate interplay of market dynamics, customer preferences, and technological advancements calls for a deeper level of insight and agility than ever before. With digital transformation setting the stage along with the Global Business Visibility buzzword, the importance of real-time and near real-time business visibility for CSPs cannot be overstated. This transformative capability, powered by future-led solutions, holds the key to enhanced decision-making, and elevated operational efficiency, and ultimately, drives the trajectory of success in the competitive telecom domain.

In the swiftly evolving landscape of the telecommunications industry, the game-changing impact of Geo Business Visibility (GBV) is now more evident than ever. As CSPs grapple with the complex challenges of a digital era, GBV emerges as the transformative force that enables these providers to gain an unprecedented level of insight into their operations. The Geospatial Analytics Market size is expected to grow from USD 74.78 billion in 2023 to USD 148.91 billion by 2028, at a CAGR of 14.77% during the forecast period. As the telecom industry races forward, CSPs that harness the transformative power of Geo Business Visibility are poised to not only navigate the complexities of today’s market but to pioneer innovation and seize new growth opportunities.

Revolutionizing Telecom Operations with Ventas Geo Business Visibility

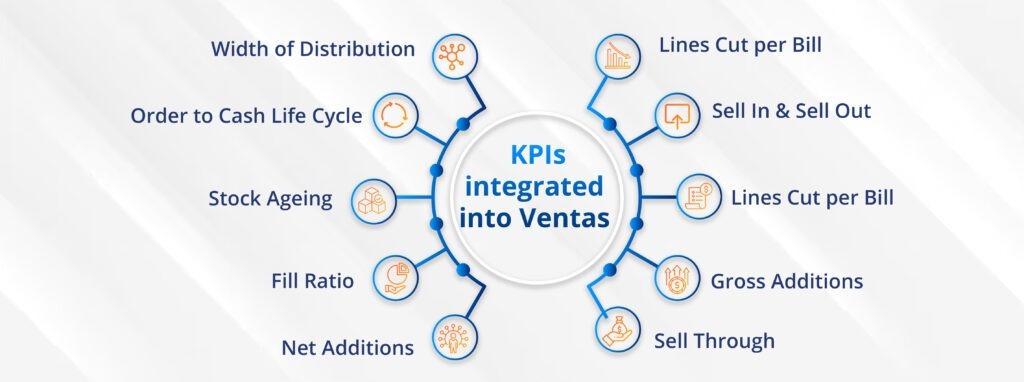

Geo Business Visibility is not just compelling but imperative for any CSP looking to thrive in 2023 and beyond. As a core component of the Ventas Sales and Distribution solution, GBV transcends traditional data analysis, offering unparalleled real-time and near real-time insights that redefine how CSPs manage crucial aspects of their business. From Sales and Stock management to Collections, Returns, Gross Additions, and Net Additions, Ventas provides a comprehensive, holistic view of operator operations, empowering decision-makers with granular data that drives strategic choices. Through its dynamic capabilities, GBV not only monitors the present but also anticipates trends, enabling proactive responses to market shifts and customer demands. Here are several essential Key Performance Indicators (KPIs) integrated into Ventas’ out-of-the-box solution:

1. Gross Additions:

This KPI offers crucial data on the total number of new subscribers being added to the operator’s network. This metric can be plotted on a daily, weekly, monthly, MTD (Month-to-Date), LMTD (Last Month-to-Date), QTD (Quarter-to-Date), and YTD (Year-to-Date) basis, allowing for precise trend analysis and strategic decision-making.

2. Churn:

Measured quarterly, this KPI focuses on the total number of subscribers who have left the operator’s network. By tracking churn rates, operators can assess customer retention efforts and devise strategies to minimize subscriber attrition.

3. Net Additions:

This KPI represents the net change in the number of subscribers over a specific period. It is calculated by subtracting the total number of subscribers who left the operator’s network from the total number of new subscribers added. A positive net addition indicates growth, while a negative value suggests a decline in the subscriber base.

4. Sell In:

Sell In, also known as primary sales, involves the sale of products or services to the first leg of the distribution value chain. This metric is measured in absolute sales amounts and can be plotted daily, weekly, monthly, quarterly, and yearly. It provides insights into the initial distribution of products within the network.

5. Sell Through:

Sell Through, or secondary sales, holds significant importance in assessing overall sales performance. It measures the sales made by the first leg of distribution to the immediate next leg within the value chain. This metric, measured in absolute sales amounts, offers critical data on the effectiveness of the distribution process and the flow of products through the channel.

6. Sell Out:

Sell Out, also known as tertiary sales, focuses on sales made directly to the end customer. This metric, measured in absolute sales amounts, provides a clear picture of the final sales performance and customer engagement. It can be plotted daily, weekly, monthly, quarterly, and yearly, allowing operators to monitor sales trends.

7. Fill Ratio:

The fill ratio is a crucial KPI that measures the efficiency of order fulfillment by the warehouse. It compares the total orders received with the total orders fulfilled in full according to the defined order fulfillment lifecycle. A higher fill ratio indicates a more efficient order processing system, enhancing customer satisfaction and reducing fulfillment delays.

8. Lines Cut per Bill:

This metric measures the number of unique Stock Keeping Units (SKUs) sold per invoice. A higher count of distinct SKUs on each invoice suggests a more diversified product offering and a better mix of products. This is essential for operators, as it indicates a wider range of products being sold, contributing to increased revenue opportunities.

9. Order to Cash Life Cycle:

This metric signifies the time taken from the creation of an order to the receipt of payment, including the fulfillment, shipment, and receipt by the beneficiary. Operators aim to minimize this lifecycle as much as possible to improve cash flow and operational efficiency.

10. Width of Distribution:

The width of distribution measures the presence of an operator’s indirect and direct channel partners in a specific geographic area. It compares the operator’s channel partners to the total channel partners of all operators combined. A wide width of distribution indicates a more extensive and comprehensive business coverage by the operator, enhancing market reach and penetration.

11. Stock Ageing:

Stock aging is a critical KPI in inventory management. It refers to the duration a specific SKU remains unsold in various locations, including operator warehouses, indirect channel partner warehouses, and operator-owned branded stores. A lower stock aging duration is advantageous, indicating efficient inventory management and minimizing the risk of stock obsolescence.

Unlocking Success with Ventas Geo Business Visibility

By providing real-time insights into critical aspects of their business, Ventas empowers CSPs to make data-driven decisions, streamline operations, and create a stronger, more efficient business model. With Ventas, CSPs gain a competitive edge in an ever-evolving industry, setting the stage for continued growth and success. This innovative module within Ventas Sales and Distribution Suite ensures that CSPs can optimize their sales performance, reduce stock aging, streamline collection processes, and create a customer-centric ecosystem that thrives in the ever-evolving telecom landscape. With Ventas GBV, CSPs possess the essential tools to revolutionize their operations and elevate their position in the competitive market, setting a new standard for efficiency, responsiveness, and success.

Thought Leadership Insights: Manoj Jain, Global Head Marketing