Gamification has been challenging traditional banking applications to implement newer features in recent times. From the elements of the characters to modernizing the application with games, implementing advanced software has resulted in influencing customer behavior by enhancing their engagement through deploying powerful tools and consumer motivation. Gamification has become a powerful tool to deliver key information by strengthening relationships and encouraging the endorsement of Digital Financial Solutions.

Recent years have been a testimony of how banks have radically changed their approach to customers. Incorporating newer elements like gamification into their platform has helped organizations increase their goodwill while educating them simultaneously through Digital Financial Services. Studies suggest that customers today love interfaces tailored to their interests, and Gamification hits just the right spot. It educates customers on finances while small wins through this system allow them to feel recognized, and valued, for feeling acknowledged for the time that they contributed towards the app. This establishes a connection with each user encouraging them to save while letting the app gain a competitive advantage in the market creating loyalty.

Gamification includes elements of gameplay that delivers key insights while making the process rewarding for its users. It takes the traditional approach by sugaring it with engaging elements through innovation and design. It can be as simple as allowing users to set saving goals and rewarding them when the goal is achieved.

Studies suggest that by 2025, the global Gamification sales revenue is estimated to reach $32 Billion. With an increase in the user application market, Companies that use gamification in their Digital FinTech Solutions can have higher conversion rates.

Overcoming Gamification Challenges in Banking

Through the years of the digital banking evolution, customer engagement has always been a set back and gamification today is creating a new narrative. Finding the right balance between innovation and servicing is allowing customers to truly experience gaming by easing their way through a traditional application. Substantially differentiating similar services can become difficult. However, the revolution of elements can create a big difference.

Privacy concern over the gamification of finances is another challenge. With the right measures and policies, CSPs can maneuver through this issue by ensuring security with every click. Creating a social component to banking, gamification has become successful in an acceptable fashion. Users’ attitude towards such innovation provides a gateway for more transformation and reconstruction.

Gamification: Digitizing the Banking and Finance Sector

It has been a tremendous step in transforming the industry and the approach toward the applications for both banks themselves and customers. The financial sector has realized that this industry need not necessarily be strict as a way of pooling in consumers.

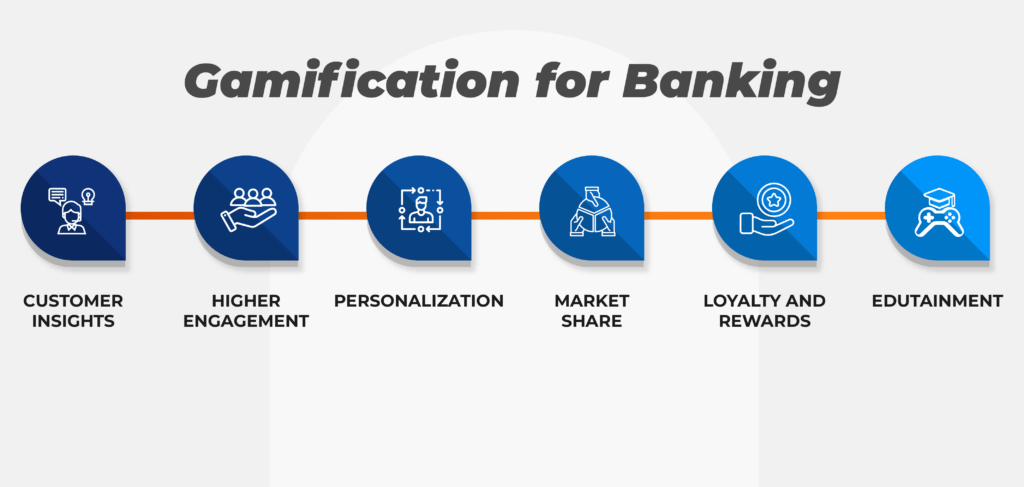

Here are some key ways gamification allows the banks to:

Tap into Newer Customer Segments

As more customers experience newer interaction methods, there is an increase in the quality and quantity of users of the application through Digital Financial Services. This solution is based on game mechanics enabling customers to interact deeper with the services. It eventually will allow the organization to use the data to further reach a wider audience in the niche. Banks that present their services innovatively let their customers understand the information at a faster pace.

Accelerate Digital Transformation in Banking

It can serve as a medium of digital transformation for the industry as well as its users. It allows organizations to gather key insights into customer patterns based on their approach to the application further creating new areas of development and renovations.

Enhance Customer Engagement

Easing the daily functionality of the app allows operations to run in a smoother and more efficient manner, increasing the overall literacy of its users. Linking accounts and effective processing will be much faster when customers involve themselves in the application through this new trend. Loyalty management can run on par with this solution allowing the organization to get their customers to employ the application.

Customer engagement is one of the core factors of the Banking Industry in 2023. With cutthroat competition, organizations are creating a Unique Selling Factor to the table. It becomes crucial to provide a service in the most cost-effective, innovative, and efficient way through digitization.

Gamification Elements

Levels

Levels allow the users to visually see their journey on the app. Creating a sense of progression and achievement provides a directional element.

Badges

Badges instill a sense of reward in the user by allocating a visual element of recognition from its user.

Points

Earring points make the user feel very valued thus increasing their engagement. It helps establish a sense of achievement and redemption. When applied correctly they can be a great tool to indicate their win.

Polls

Polls make the users feel heard. Understanding their expectations is an effective way to collect data and provide the right services to get a complete sense of customization from both ends.

Key Components of Gamification in Digital Financial Solutions

It is not just about including activities in a user application. It rouses curiosity motivating the users by imbibing a sense of accomplishment leading to overall application growth and expansion. Some of its elements that can spark user interest are:

- Stay active and Win

- Sake and Win

- Predict and Win

- Refer and Win

- Download and Win

- Spin and Win

- Jackpot

- Guess and Win

- Festive offers

- Daily challenges

- Lottery

- Roll and Win

- Quizzes

Leverage Gamification to Retain Customers for Life

Gamification has been a significant success and has proven to be key in driving customer satisfaction through engagement while retaining current users. Many financial institutions are reconstructing their systems to incorporate and deploy various techniques of Gamified solutions.

6D’s Aureus, a Digital Financial Solution is a Gamification platform that enables CSPs to adapt to their architecture by recognizing their behavior with the right tools. Its innovative system offers customizable plugins to engage the users in a reward system through virtual elements: badges, challenges, spend and win games. This allows organizations to integrate mobile money with monetary and non-monetary rewards for users. Gamification creates opportunities for businesses to build strong bonds using their data which provides insights for further development.

Banks have already identified and tapped into this potential by actively pacing towards incorporating this solution into their daily operations. Gamification is restructuring many industries, is your business gamification ready?

If you have any questions or comments, contact us.