In the dynamic realm of fintech, mobile wallet solutions have become an indispensable tool, revolutionizing the way we look at money and finances. We are leaving behind the days of wallets stuffed with cards and cash; consumers now are reaching for the convenience of having the world of finances in their hands. Mobile wallet solutions provide a convenient and secure way to make digital payments and carve a path for effortless banking transactions, fund transfers, and expense tracking all with just a few taps on a smart device. As we become more digitized, today mobile wallets have become more than just an accessory of convenience but rather a fundamental shift in the interaction with money.

Shifting towards a world of digitized platforms, we see a global shift towards fintech integrating mobile wallet solutions as part of their offerings. Apart from being an unparalleled convenience to consumers, the technology also hosts a plethora of benefits for businesses and financial institutions. Fintech companies can now seamlessly integrate mobile wallet payment solutions in their operations to enhance user experience, unlocking new revenue streams by reducing overall costs.

The Mobile Wallet Market size is estimated at $13.79 billion in 2024 and is expected to reach $45.17 billion by 2029, growing at a CAGR of 26.78% during the forecast period (2024-2029). The widespread adoption of this technology has enabled banking services to foster inclusivity for the underserved population in recent times.

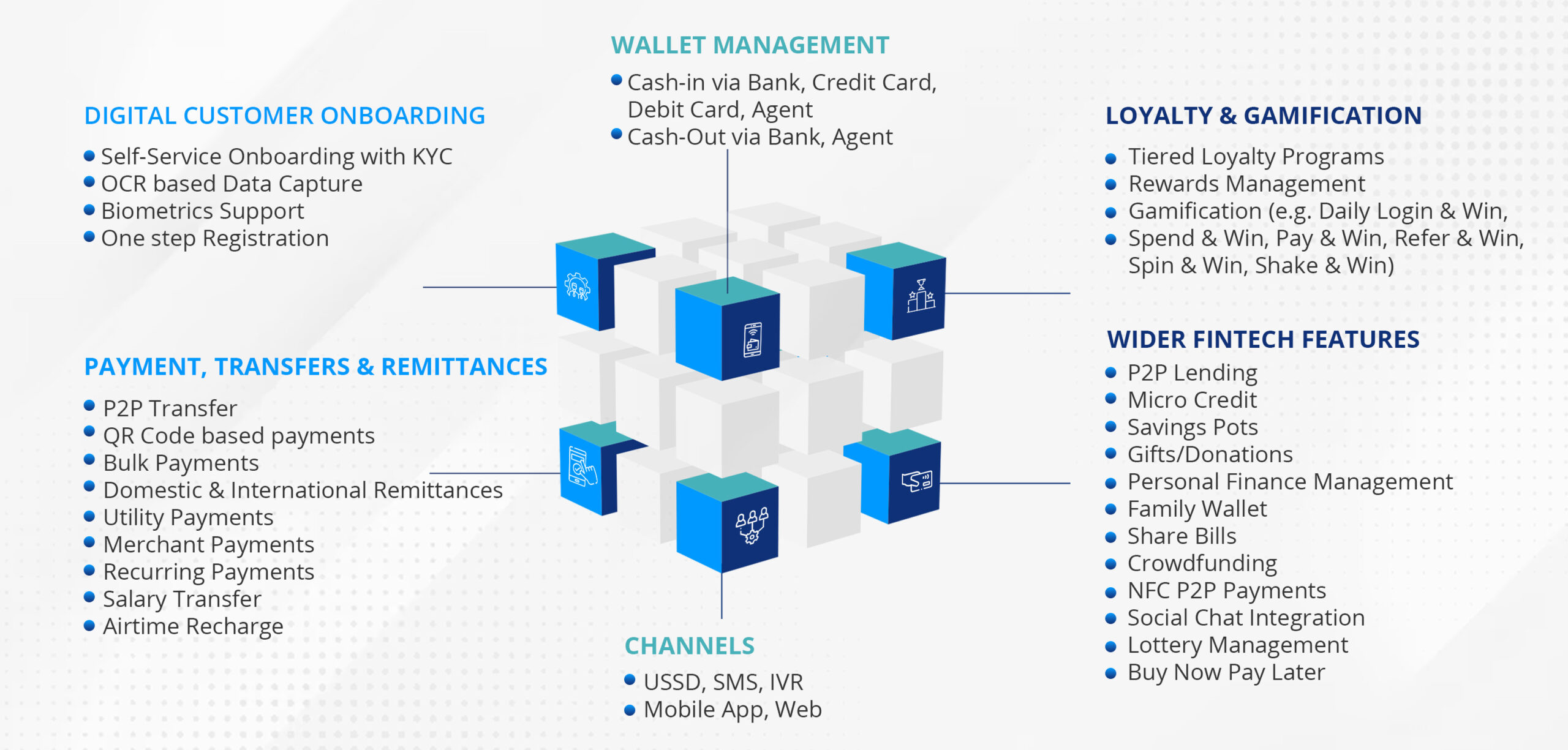

Unlocking Mobile Wallet Solutions Potential: Key Capabilities

Digital Customer Onboarding

Revolutionizing the way financial services and individuals engage, digital customer onboarding represents the cornerstone of mobile wallet solutions capabilities. Through integrated KYC protocols, consumers can now seamlessly verify and register their identities from their smart devices comfortably. Eliminating the need for manual entry of data, OCR empowers mobile wallet users by seamlessly capturing personal information. Moreover, Biometric support provides an additional layer of convenience and security that allows users to authenticate their identities through fingerprint and facial recognition.

This technology also expedites the onboarding experience by minimizing the barriers to entry and maximizing user adoption with one-step registration. Focusing on user satisfaction, this streamlines the approach to a diverse range of individuals.

Wallet Management

Wallet management empowers users with unparalleled control over their money management, facilitating seamless transactions. Users can now conveniently top up their wallets from various sources with options like bank transfers, credit card payments, or designated agents. This multi-channel approach caters to diverse users’ preferences and needs through its vast accessibility and flexibility.

Similarly offering liquidity and convenience, the cashout feature enables users to withdraw funds from their banks or authorized agents. Mobile wallet payment solutions provide users with the freedom and flexibility to manage their finances efficiently whether depositing funds for future transactions. By offering a comprehensive suite of wallet management features, users can take control of their finances, simplifying transactions and the overall well-being of their finances.

Payment, Transfers, and Remittances

Diverse capabilities like P2P transfers enable seamless money exchanges through instant transactions between individuals with just a few taps on the screen. Secure and contactless payments allow users to make seamless transactions with QR code-based payments. Moreover, bulk payments with mobile wallet solutions enable businesses to disburse salaries, incentives, and bonuses to multiple accounts simultaneously enhancing efficiency and reducing administrative load. Mobile wallet payment solutions also facilitate international transactions along with domestic transfers making it a cost-efficient and efficient means for individuals to move money across borders.

Mobile wallets for merchants offer a seamless avenue for receiving payments from both offline and online modes fostering a frictionless checkout experience. Recurring payment functionality enables users to automate transactions including bill payments, subscriptions, and loan payments without the need for manual intervention.

Enabling employers to disburse wages directly to employees promotes financial inclusion and reduces the reliance on cash-based traditional payrolls. Uninterrupted communication and connectivity is now a functionality that allows consumers to top up their mobile phone credits instantly. Boiling it down, payments, remittances, and transfers empower users with unparalleled convenience, efficiency, and flexibility in managing transactions whether locally or across the globe.

Channels

With their wide range of channels for users to access and seamlessly manage their finances, mobile wallet solutions ensure inclusivity and accessibility across a large range of demographics. USSD, SMS, and IVR systems typically cater to consumers with basic devices, offering simple text or voice-based interactions for transactions. This empowers users with no access to smart devices to participate in connectivity for a digital financial ecosystem. Leveraging a range of functionalities, mobile apps, and web interfaces allows users to access their finances on the go. This enables users to manage their finances, ensuring a consistent user experience.

Loyalty and Gamification

Loyalty and gamification experiences for users can transform financial transactions into a rewarding user experience within mobile wallet payment solutions. By offering rewards and benefits based on transactions, loyalty programs engage with users regularly. Incentivizing consumers with cashback and discounts, this technology allows users to redeem discounts and perks therefore increasing their loyalty to the product.

Gamification elements add a sense of fun and excitement to users fostering a sense of achievement. The gamification mechanism adds motivation to users to dive deeper into the features of the application through challenges, games, and quizzes. With a dynamic and immersive experience, consumers are incentivized to actively participate to cultivate and create a sense of brand loyalty.

Wider Fintech Features

Mobile wallet solutions are beyond just traditional features but go on to offer an array of features to cater to the growing needs of consumers according to their preferences. Users are now empowered to borrow and lend funds within the ecosystem with P2P lending capabilities. Microcredit functionalities also provide access to consumers to meet their financial needs short term.

Users can also set aside funds for their goals, enabling users to achieve their objectives with saving pots. This integration of gifts and donations allows users to contribute to charitable causes as well. With tools like advanced personal finance management, consumers can now also have a deeper insight into their habits, goals, and budgeting habits empowering them to make smarter decisions. Family wallets also enable consumers with collective family users to make their financial management easier for fund transfers and household expense tracking.

Crowdfunding functionality with this solution also enables users to raise funding for their projects or contribute towards charitable initiatives allowing the collective aid of social networks. NFC-enabled P2P payments leverage contactless transactions by near-field communication to harness convenience and security.

Buy now and pay later options allow customers to have flexibility in payments, therefore enhancing affordability with a diverse range of users. With a plethora of fintech features, mobile wallet solutions in today’s digital environment empower everyone to manage and encourage financial management.

The Indispensable Role of Mobile Wallets Solutions in Fintech Digitization

Concluding this blog, in the realm of fintech, mobile wallet solutions have become an indispensable tool in reshaping the way money is managed. With convenience, security, and adaptability, mobile wallet payment solutions are reshaping the financial world. With the plethora of innovative features and versatility, users are now empowered to take control of their financial lives. As a pioneering force in fintech, 6D Technologies stands at the forefront of this seamless integration of mobile wallets into the digital ecosystem.

Aureus, a digital financial solution that serves as a core element of the mobile wallet ecosystem. With a reliable and scalable platform, Aureus ensures seamless interoperability, security, and compliance making it a trusted and dependable partner for businesses. As the world becomes increasingly digitized, mobile wallets will continue to play a pivotal role in driving financial inclusion, fostering innovation, and shaping the future of finance.